Press

Formal Statement from Palladyne International Asset Management B.V.

Recent publicity

Recently, allegations about our investment capability and our professionalism have been aired. We strongly oppose these unfounded assertions. Allegations have also been made that PIAM has been accused of “siphoning off” Libyan monies. These are false and libelous allegations.

Below are statements from PIAM:

The above mentioned allegations first surfaced on or around the 2011 Arab Spring events in connection with our work for LIA, during our attempt to seek a resolution to disputed trades with Goldman Sachs. These allegations were further exacerbated by a doctored and misleading report dated September 2010 relating to LIA’s holdings.

In line with our policy, we generally do not comment on our clients. However, under the current circumstances, we feel that it is required to state that with full certainty and demonstrable capability, the only Libyan state monies we manage are with Libyan state financial institutions. PIAM has no relationship whatsoever with other Libyan state institutions nor sectors, in particular the oil sector. We manage all funds in accordance with all appropriate rules, laws and regulations and can demonstrate and confirm that every penny has been accounted for.

There are persistent attempts to link Mr. Abudher with the former Libyan regime and to create the impression that the company’s success is owed to this link. Both these allegations are wrong. Our Chief Executive, Mr. Ismael Abudher, has never been part of any Libyan regime.

We and our Directors have cooperated fully with the Dutch authorities in connection with their investigation. However, we are still not clear as to the basis of this investigation and indeed, no evidence has been placed before our Company, our Directors, and/or our legal advisors. Furthermore extensive due diligence and review by the Company’s lawyers, forensic experts and other professionals, has not resulted in anything that could possibly support any of the wild allegations made thus far.

Fundamental Inaccuracies

Recent publications concerning PIAM contain numerous highly inaccurate and easily verifiable facts.

- PIAM has never managed monies for any Libyan state institution in the oil and energy sector.

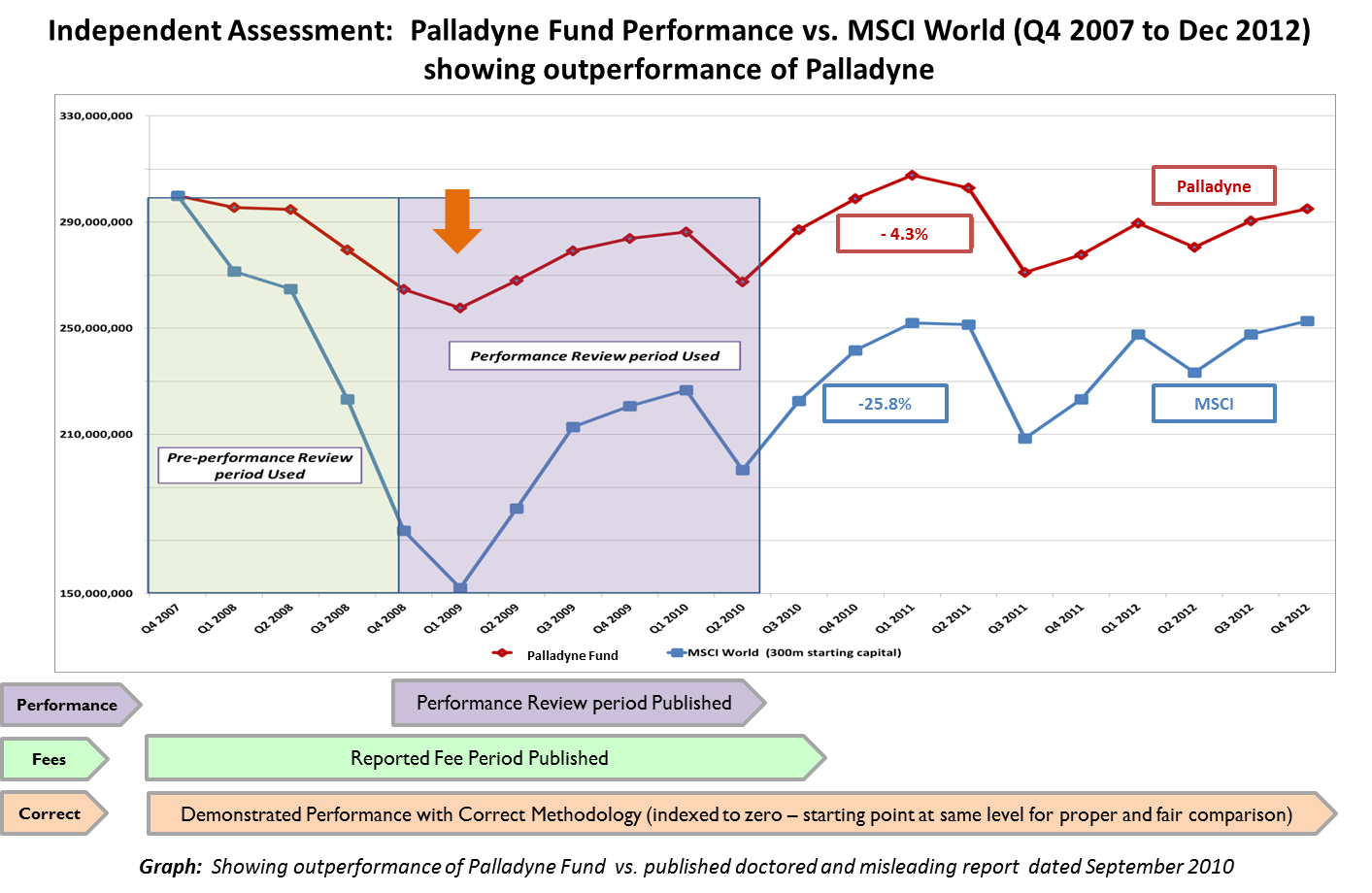

- Some media publications refer to a doctored and misleading report relating to the Libyan Investment Authority’s holdings dated September 2010 which provides entirely misleading and inaccurate information about PIAM’s Fund fees and performance. Contrary to the figures stated in this “Report” the PIAM Fund has actually outperformed the MSCI by 21.5% (after fees) from December 2007 to September 2010 and has actually continued to outperform post 2010 as demonstrated in the graph below.

- The doctoring is evident from the fact that in the doctored and misleading report, two graph lines allegedly comparing the performance of our Fund with that of the MSCI Index do not start from the same level. (indexed to zero).

- The doctoring is evident from the fact that there are multiple data point issues which are identified in the commentary underneath the graph above.

- Certain media have tried to tarnish the relationship between PIAM and its Public Affairs advisor, the firm “Meines Holla & Partners” in The Hague. The facts are as follows: PIAM entered into a normal engagement agreement with Meines Holla & Partners, from which it also received invoices for services rendered. PIAM did not engage or pay Dr Ben Bot, a partner of Meines Holla & Partners directly, neither privately nor via his personal holding company.

Track Record and Performance

Our overall track record of the various investment mandates that we manage, indicates, over the current lifetime of the mandates, above average performance when compared to the relevant benchmark of each mandate. These mandates strive to achieve sustainable growth taking into consideration each clients desired target risk and return.

An example of our excellent performance, as demonstrated in the graph below, PIAM successfully outperforms the MSCI benchmark. This is contrary to a doctored and misleading report that has been published. The graph below shows PIAM’s net and actual performance (red line) to the end of 2012 as assessed by certified independent forensic accounting experts. It shows that not only did the Fund managed by Palladyne outperform until September 2010, but also continued to outperform past 2010.

At the depth of the financial crisis of 2008, the performance of the investments in this Fund was 30% better than the benchmark based on PIAM’s proprietary investment model. (See the orange arrow on the graph below).

Please note: the MSCI’s performance (blue line) is exclusive of all fees, transaction costs etc. whereas PIAM performance below is inclusive of all fees and costs. Despite this visible outperformance, PIAM fees are within accepted industry norms. In additional independently reviewed reports, PIAM also outperforms various published industry standard benchmarks (e.g. HRFX).

As can be seen from above, PIAM’s performance of the Fund was and is significantly better than the benchmark. We can further confirm that the outperformance continues to this date.

Palladyne: A long standing professional Dutch firm

Palladyne International Asset Management (PIAM) is an asset management firm, based in the Netherlands operating from our offices in Amsterdam. Staffed by approximately 30 experienced professionals, we provide investment solutions with the highest standard of trust. Under the proprietary “Man and Machine” methodology, we apply a highly structured and disciplined approach through a combination of fundamental, technical analysis and modern quantitative tools integrated with robust risk control. Through this approach, the firm analyses, evaluates and ranks over 50,000 securities worldwide on a weekly basis.

With a legacy of more than 20 years in the Netherlands and formed from highly reputable global financial institutions, PIAM is a Dutch company subject to and fully compliant with Dutch law and has always conducted our business at the highest of standards.

Mr. Ismael Abudher, our Managing Director, is a Dutch citizen of Libyan origin. He has risen through the ranks of the company over the past 18 years through demonstration of technical skill and expertise in financial engineering and management. Mr. Abudher holds a MBA degree from Nyenrode University. From there, he was hired as a research analyst and investment manager at PIAM, taking on responsibility of training teams of investment professionals. Subsequently he was responsible for leading the modelling and evolution towards the second and third generation of the investment models across asset classes that invest globally based on the proprietary fundamental, technical and quantitative investment approach of PIAM.

We fully support and trust in the integrity and reliability of our Managing Director.